Located in Sunny Florida

5/5

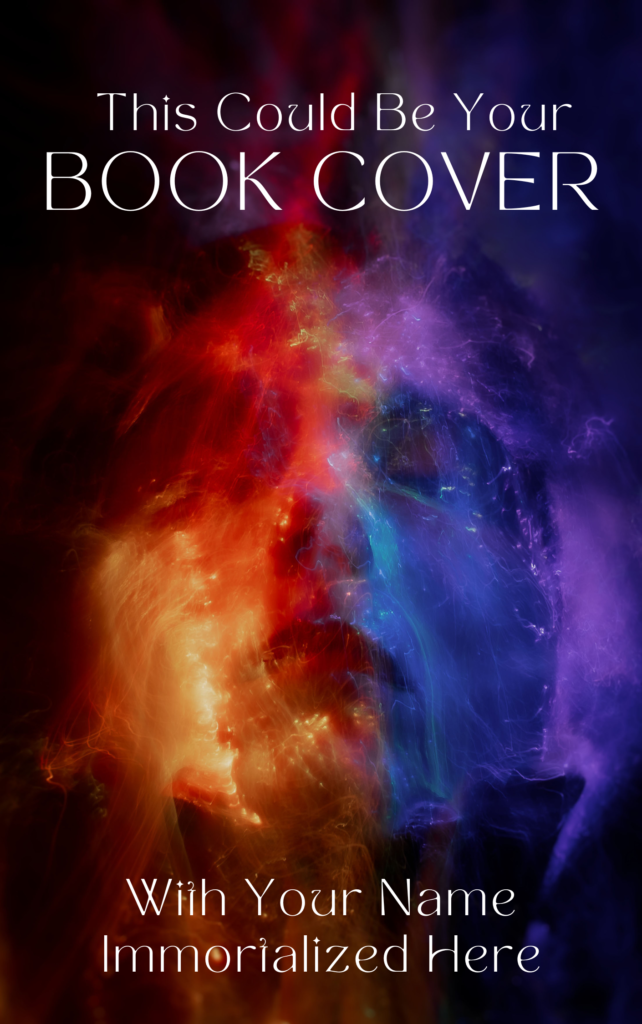

Make Lasting Impressions

Contact Wild Bohr Designs for all your creative Ideas

From book covers, logos, photography to flyers, poster, business cards

We strive to make your most cherished ideas timeless treasures for generations.